The Industria4.0 plan, recently launched by the Ministry of Economic Development (MISE), is a very important part of the Italian “Recovery Fund” plan.

It foresees a structural investment of 24 billion euros for a measure that becomes structural and that sees the strengthening of all the deduction rates and an important advance in time of fruition.

The new Transition 4.0 National Plan has two fundamental objectives:

- Stimulate private investments;

- Give stability and certainty to companies with measures that take effect from November 2020 to June 2023

New duration of the measures:

- The new tax credits are planned for 2 years;

- The effective date of the measure is brought forward to November 16, 2020;;

- The possibility, for contracts for the purchase of capital goods defined by 31/12/2022, to benefit from the credit with the sole payment of a deposit equal to at least 20% of the total amount and delivery of the goods in the following 6 months (therefore, by June 2023).

Advance payment and reduction of compensation with greater tax advantage in the year:

- For investments in capital goods “ex super” and intangible assets not 4.0 made in 2021 by persons with revenues or compensation of less than 5 million euros, the tax credit is usable in one year;

- Immediate offsetting (from the current year) of the credit relating to investments in capital goods is allowed;

- For all tax credits on tangible capital goods, the use of credits is reduced to 3 years instead of the 5 years provided for under current legislation.

Increase in ceilings and rates (tangible and intangible assets):

- Increase from 6% to 10% for all tangible capital goods credit (formerly super) for the year 2021 only;

- Increase from 6% to 15% for investments made in 2021 for the implementation of agile work;

- Extension of the credit to intangible assets not 4.0 with 10% for investments made in 2021 and 6% for investments made in 2022.

Increased caps and rates (tangible assets 4.0):

- For expenditures of less than €2.5 million: new rate at 50% in 2021 and 40% in 2022;

- For expenditure of over 2.5 million euros and up to 10 million euros: new rate of 30% in 2021 and 20% in 2022;

- For expenditure of over 10 million euros and up to 20 million euros, a new ceiling has been introduced: 10% rate in 2021 and 2022.

The MISE plan is definitely a great opportunity to take advantage of all the great opportunities offered by the new digital revolution of processes: interconnection.

Only some types of machinery can take advantage of this incentive, and only if they comply with the technical specifications of the Industry4.0 plan.

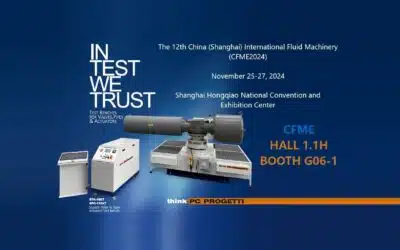

The test benches fall into the categories of machinery allowed, therefore THINK’PC PROGETTI has developed machine control systems interconnected via LAN Ethernet to the company management system, from which they receive all machine configurations (product, recipes) automatically.

They are able to respond to queries from the management super visor on their productivity, on the product currently being processed, on their operating status, through an HTTP communication protocol.

They are always connected remotely to THINK’PC PROGETTI, for constant technical monitoring in the event of calibration / training / reprogramming / troubleshooting procedures.

They have intelligent human-machine interfaces (HMI) that support the operator in terms of safety and efficiency of machining operations, and allow local configuration if necessary.

All SKA class pressurization skids can be equipped with TestRec 4.0 software

Below is an example of the tax savings that can be achieved by purchasing a test bench in 2021.

We recommend you to contact your Accountant for any further information or advice.